Investment Banking Innovative Financial Services

More than 12 years of fame for successful structured financing, M&A transactions, corporate advisory services, precise valuations, and more.

At the heart of our mission is a relentless commitment to fostering growth and sustainability. For more than 12 years, our dedicated GDC team has been serving as trusted partners to leading corporations, esteemed financial institutions, and savvy investors.

Our services are designed to empower businesses on their growth journey. Whether it’s structuring secured financing solutions, providing expert valuations for organizations and portfolios, or guiding clients through unique and complex situations, we’re here to offer comprehensive support. In today’s dynamic and ever-evolving economy, we stand out with our resourceful and proactive team. We believe in adaptability and constant improvement, making us well-equipped to thrive in changing circumstances.

We facilitate our clients' access to equity financing from both global and local sources, providing comprehensive issue management and advisory services for structuring and raising capital.

Our unparalleled expertise in structuring capital base of our clients to support an optimal level of leverage through debt financing solutions with ideal balance of cost, efficiency and debt burden.

Our team of seasoned professionals is dedicated to offering comprehensive advisory services encompassing a wide spectrum of mergers and acquisitions transactions.

Our advisory team delivers comprehensive and innovative financial services to empower our clients in making informed financial decisions and supporting businesses.

We provide expert management services to ease the burden of investor monitoring, ensuring consistent returns while leveraging our expertise to deliver valuable benefits.

Our services encompass investment management, estate planning, corporate finance counsel, and specialized wealth management products, all tailored to address the distinct financial requirements of our clients.

Learn more>

Our team focuses on identifying companies in need of equity funding that exhibit both high-quality businesses and strong management teams with the commitment to clients extends far beyond the conclusion of a transaction.

We have been acting as one of the potential financing partners for arrangement of funds for the PPP projects. Blending private investment with key public sector investment areas has been a revolution in Bangladesh Market.

Milestone Deals

Issuance of First-Ever Sustainability Bond of

BDT 2,675 Million

CERTIFIED BY MOODY’S

Mandated Lead Arranger

Raising Long Term Foreign Currency Loan

Up to USD 100 Million

Patenga Container Terminal Project

Mandated Lead Arranger

Raising Long Term Foreign Currency Loan

Up to USD 31Million

THE FIRST EVER PRIVATE SECTOR

INLAND CONTAINER RIVER TERMINAL FACILITY

Mandated Lead Arranger

Acquired 2 Malaysian firms in a transaction of

USD 78 Million

FIRST EVER CROSS BORDER M&A

TRANSACTION FROM BANGLADESH

Mandated Lead Arranger

Foreign Debt Syndication & Bonds

RSGT Bangladesh Limited

USD 100 Million

Mandated Lead Arranger

Pubali Bank Limited

USD 30 Million

Mandated Lead Arranger

Summit Alliance Port Limited

USD 31 Million

Mandated Lead Arranger

PRAN-RFL Group

USD 25 Million

Mandated Lead Arranger

LankaBangla Finance

USD 21 Million

Mandated Lead Arranger

Local Debt Syndication & Bonds

Runner Automobiles Limited

Sustainability Bond

BDT 2,675 Million

Mandated Lead Arranger

Fair Electronics Limited

Short Term Financing

BDT 1,000 Million

Mandated Lead Arranger

Summit Alliance Port Limited

Long Term Financing

BDT 1,000 Million

Mandated Lead Arranger

Rangs Electronics Limited

Long term and Short Term Loan Arrangement

BDT 1,500 Million

Mandated Lead Arranger

LankaBangla Finance Limited

Subordinated Bond

BDT 3,000 Million

Mandated Lead Arranger

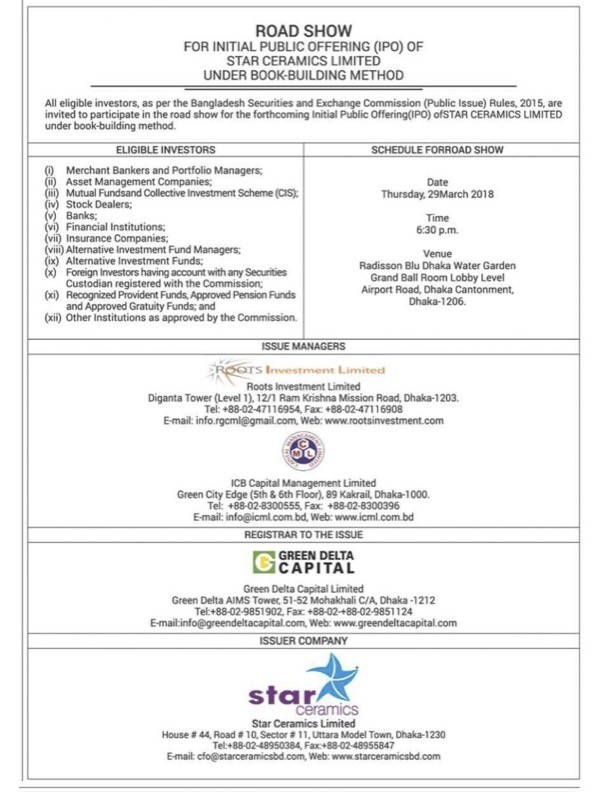

Equity

Thai-Foils & Polymer Industries Ltd. Equity

Initial Public Offering

Book Building Method

Mandated Issue Manager

Petrochem (Bangladesh) Limited

Initial Public

Offering

Mandated Issue Manager

Feni Lanka Power Company Limited

Initial Public Offering under

Book-Building Method

Sole Mandated Issue Manager

Craftsman Footwear and Accessories Ltd.

Qualified Investor Offer

(QIO)

Mandated Issue Manager

Runner Automobiles Limited

Preference Shares

BDT 2000 Million

Mandated Lead Arranger

Merger & Acquisition

Akij Group

Buy-Side Advisory

services for acquiring

2 Manufacturing Units in

Malaysia

Scatec ASA

Sell-Side Advisory

services for 50 MW AC

Solar Power Project in

Bangladesh

Corporate Advisory, Valuation & Other Services

Ananta Apparels Limited

Financial Valuation

Valuation & Advisory Services

Novoair Limited

Financial Valuation

Company Valuation

Unique Meghnaghat Power Limited

Financial Valuation

Valuation & Advisory Services

Agora Limited

Company Valuation

Valuation & Advisory Services

STS Holdings Limited

Valuation to Identify Share Transfer Value

Company Valuation