Equity Origination

Strengthening Capital Positions

Within our Corporate & Institutional Investment Banking division, our core focus is on fortifying our clients’ financial foundations and enhancing their capital structures. Our global presence combined with localized expertise enables us to establish vital connections with an extensive range of equity financing sources, encompassing both private and public options.

We deliver end-to-end services, thorough issue management and advisory support to structure and execute equity offerings. Our dedication to clients goes beyond mere connections; it involves comprehensive assistance in managing and shaping equity issuances, ensuring they can efficiently secure the capital essential for their growth and strategic pursuits.

Public Equity Issuance:

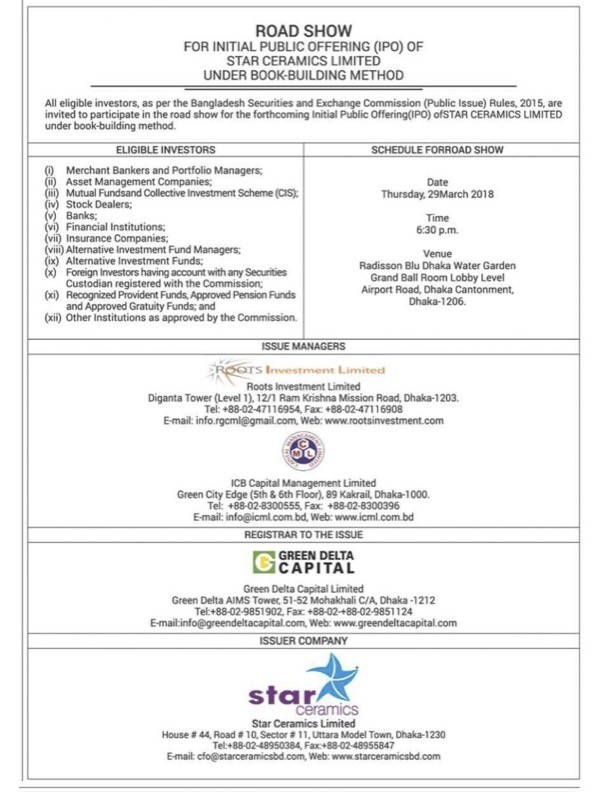

- Initial Public Offering (IPO)

- Qualified Investor Offer (QIO)

- Repeat Public Offering (RPO)

- Rights Issue Offering

- Underwriting

- Listing in Foreign Stock Exchanges

Private Equity:

- Preference Share Issuance

- Strategic Equity Partnership Investment from Global and Local Investor pools

Key Transaction Highlight

Equity Origination

Thai-Foils & Polymer Industries Ltd. Equity

Initial Public Offering

Book Building Method

Mandated Issue Manager

Petrochem (Bangladesh) Limited

Initial Public

Offering

Mandated Issue Manager

Feni Lanka Power Company Limited

Initial Public Offering under

Book-Building Method

Sole Mandated Issue Manager

Craftsman Footwear and Accessories Ltd.

Qualified Investor Offer

(QIO)

Mandated Issue Manager

Runner Automobiles Limited

Preference Shares

BDT 2000 Million

Mandated Lead Arranger

Alliance Holding Limited

Initial Public Offering

Mandated Co-Issue Manager

EON Agro Industries Limited

Qualified Investor Offer

(QIO)

Mandated Lead Arranger

BD Venture Limited

Capital Raising of

BDT 32.50 Million

Mandated Issue Manager

Union Capital Limited

Issuance of Preference

Stock of

BDT 600 Million

Mandated Lead Arranger

EON Animal Health Products Limited

Qualified Investor Offer

(QIO)

Mandated Lead Arranger